Introduction

In a significant step towards streamlining and automating GST compliance, the Goods and Services Tax Network (GSTN) has authorized a set of e-invoice verification app. These apps are designed to simplify the process of verifying B2B e-invoices, ensuring accurate input tax credit claims and enhancing overall tax compliance.

The Role of Authorised e-Invoice Verification App

Authorised e-invoice verification app play a pivotal role in the e-invoicing ecosystem by providing a reliable and efficient mechanism for verifying the authenticity and accuracy of B2B e-invoices. These apps are designed to:

- Validate e-invoices: Ensure that e-invoices adhere to the prescribed format and contain all mandatory information.

- Verify the IRN: Cross-check the Invoice Reference Number (IRN) generated by the GSTN portal to confirm its authenticity.

- Detect errors and discrepancies: Identify any errors or inconsistencies in the e-invoice data, such as incorrect GST rates, missing information, or invalid HSN codes.

- Prevent fraud and tax evasion: Safeguard businesses from fraudulent activities by ensuring that e-invoices are genuine and comply with tax regulations.

- Facilitate seamless integration: Integrate with accounting and ERP software to automate the e-invoicing process and reduce manual intervention.

- Provide real-time updates: Keep businesses informed about the latest e-invoicing regulations and updates.

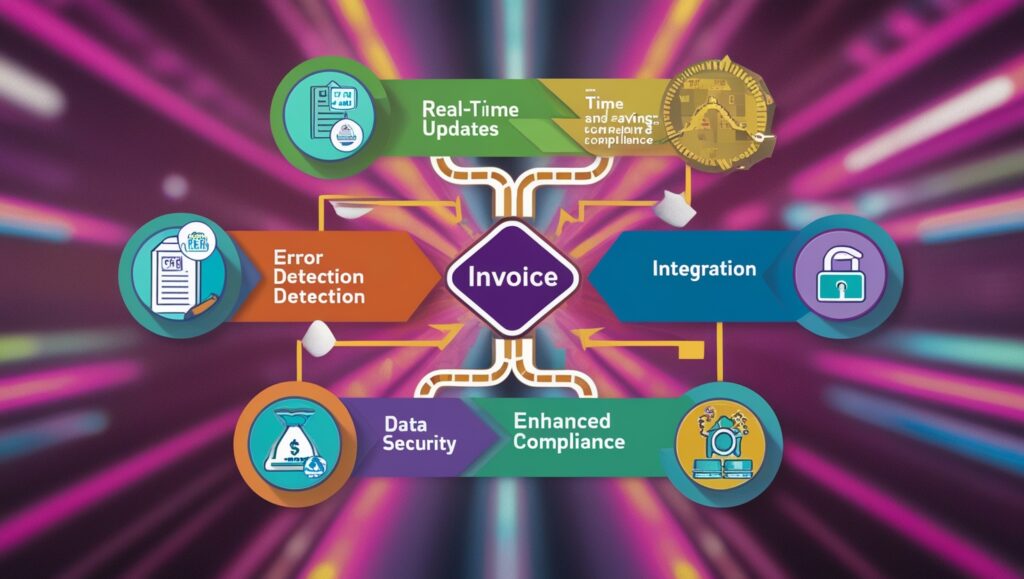

Key Features and Benefits of Authorised e-Invoice Verification App

Authorised e-invoice verification app offer a range of features and benefits that can significantly improve business operations:

- Real-time validation: Instant verification of e-invoices to ensure timely input tax credit claims.

- Enhanced accuracy: Minimization of errors and discrepancies in e-invoices, leading to accurate tax calculations and reporting.

- Improved compliance: Adherence to GST regulations and avoidance of penalties and legal issues.

- Streamlined workflows: Automation of the e-invoicing process, reducing manual effort and saving time.

- Enhanced security: Robust security measures to protect sensitive financial data and prevent cyberattacks.

- Seamless integration: Compatibility with various accounting and ERP software.

- User-friendly interface: Easy-to-use interface for hassle-free verification.

Security Measures in Authorised e-Invoice Verification App

Security is paramount in the realm of e-invoicing. Authorised e-invoice verification apps employ robust security measures to protect sensitive financial data:

- Encryption: Encryption of data during transmission and storage to prevent unauthorized access.

- Secure authentication: Strong authentication mechanisms, such as multi-factor authentication, to safeguard user accounts.

- Regular security audits: Periodic security audits to identify and address vulnerabilities.

- Compliance with data privacy regulations: Adherence to data privacy laws and regulations, such as GDPR and CCPA.

- Secure data centers: Data centers with advanced security measures to protect data from physical and cyber threats.

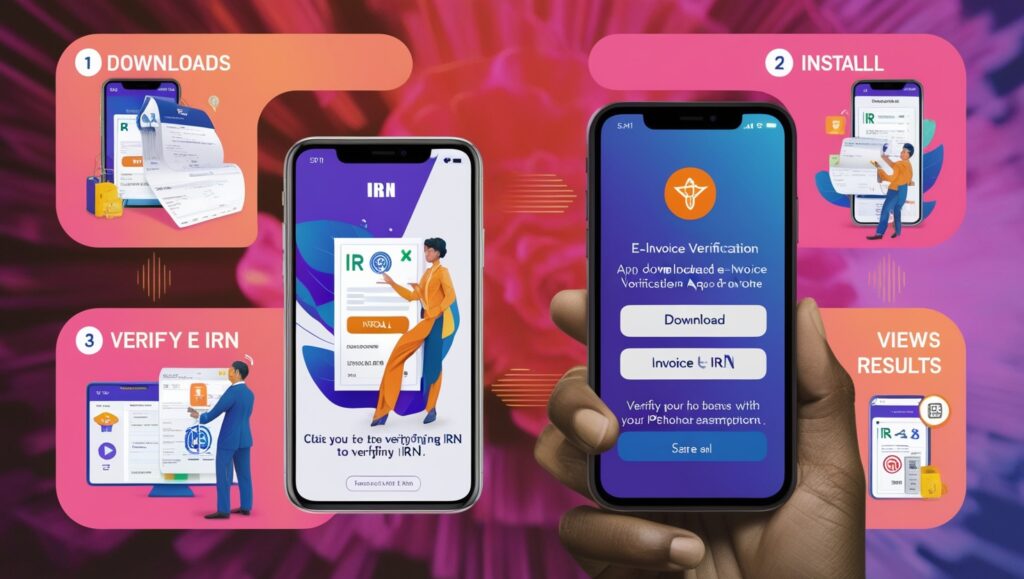

How to Use Authorised e-Invoice Verification App

To utilize these apps, follow these general steps:

- Download the App: Choose an authorized app from the list provided by GSTN and download it from the respective app store.

- Install the App: Install the app on your smartphone or tablet.

- Open the App: Launch the app and provide the necessary permissions.

- Verify e-Invoice: Enter the IRN (Invoice Reference Number) of the e-invoice you want to verify.

- View Verification Results: The app will fetch the e-invoice details from the GSTN portal and display the verification status.

You can download all App by scanning Qr code through this pdf .

Authorized e-Invoice Verification App

Here are five authorized e-invoice verification apps, along with their key features and benefits:

1. EY e-Invoice Verification App

- Objective: To provide a user-friendly and efficient solution for verifying B2B e-invoices.

- Features:

- Real-time verification of e-invoices

- Detailed invoice information display

- Easy-to-use interface

- Push notifications for important updates

- Benefits:

- Ensures accurate input tax credit claims

- Reduces manual verification efforts

- Streamlines the invoice verification process

- How to Use:

- Download the EY e-Invoice Verification app.

- Install and launch the app.

- Enter the IRN of the e-invoice you want to verify.

- View the verification results and detailed invoice information.

2. Cygnet e-Invoice Verification App

- Objective: To enable real-time verification of B2B e-invoices on mobile devices.

- Features:

- Quick and accurate verification

- Offline access to verified invoices

- Customizable alerts and notifications

- Secure and reliable data transmission

- Benefits:

- Simplifies the verification process for businesses on the go

- Provides access to verified invoices even without internet connectivity

- Ensures timely and accurate input tax credit claims

- How to Use:

- Download the Cygnet e-Invoice Verification app .

- Install and launch the app.

- Enter the IRN of the e-invoice you want to verify.

- View the verification results and detailed invoice information.

3. NIC e-Invoice Verification App

- Objective: To offer a government-backed solution for e-invoice verification.

- Features:

- Direct access to GSTN data

- Real-time verification updates

- Secure and reliable platform

- User-friendly interface

- Benefits:

- Ensures the authenticity of e-invoices

- Provides accurate and timely verification results

- Offers a trusted solution backed by the government

- How to Use:

- Download the NIC e-Invoice Verification app.

- Install and launch the app.

- Enter the IRN of the e-invoice you want to verify.

- View the verification results and detailed invoice information.

4. IRIS e-Invoice Verification App

- Objective: To provide a comprehensive solution for e-invoice verification and other GST compliance tasks.

- Features:

- Real-time e-invoice verification

- GST return filing and reconciliation

- E-way bill generation and tracking

- Taxpayer services and information

- Benefits:

- Streamlines multiple GST compliance tasks in a single app

- Ensures accurate and timely e-invoice verification

- Provides a holistic solution for GST compliance needs

- How to Use:

- Download the IRIS e-Invoice Verification app.

- Install and launch the app.

- Enter the IRN of the e-invoice you want to verify.

- View the verification results and detailed invoice information.

5. GSTN e-Invoice Verification App

- Objective: To provide an official platform for verifying e-invoices directly from the source.

- Features:

- Real-time access to GSTN data

- Accurate and reliable verification

- Secured and trusted platform

- User-friendly interface

- Benefits:

- Ensures the highest level of security and accuracy

- Offers a direct link to the official GSTN platform

- Provides a trusted solution for e-invoice verification

- How to Use:

- Download the GSTN e-Invoice Verification app.

- Install and launch the app.

- Enter the IRN of the e-invoice you want to verify.

- View the verification results and detailed invoice information.

Conclusion

The introduction of authorized e-invoice verification apps has significantly simplified the process of verifying B2B e-invoices.

By leveraging these apps, businesses can streamline their GST compliance efforts, reduce errors, and ensure accurate input tax credit claims. It is recommended to choose an app that best suits your specific needs and preferences. By effectively utilizing these apps, businesses can enhance their overall tax efficiency and focus on core operations.

What are e-invoice verification apps, and why are they important?

How do authorized e-invoice verification apps work?

What are the benefits of using e-invoice verification apps for businesses?

Which are the top authorized e-invoice verification apps?

How do e-invoice verification apps help in claiming input tax credit (ITC)?

Are e-invoice verification apps secure to use?

Can e-invoice verification apps integrate with ERP and accounting software?

What steps should I follow to use an e-invoice verification app?

What are the most common errors detected by e-invoice verification apps?

Are there free e-invoice verification apps available?

For more update GST Visit here.