Updates to E-Way Bill and E-Invoice Systems

The Government of India, through the GST Network (GSTN) and the National Informatics Centre (NIC), has announced significant updates to the E-Way Bill and E-Invoice systems. These updates, which will come into effect starting January 1, 2025, are designed to enhance the security, efficiency, and compliance of these critical platforms. In this article, we will explore these updates in detail and understand their implications for taxpayers and businesses.

Introduction to E-Way Bill and E-Invoice Systems

The E-Way Bill (EWB) and E-Invoice systems are essential components of India’s Goods and Services Tax (GST) framework. The E-Way Bill system is used to track the movement of goods across the country, ensuring transparency and compliance with GST laws. The E-Invoice system, on the other hand, standardizes invoice generation and reporting for businesses. Together, these systems streamline business processes and improve tax compliance. The latest updates to E-Way Bill and E-Invoice Systems are part of the government’s ongoing efforts to align these platforms with global best practices and strengthen their security features.

Key Updates to E-Way Bill and E-Invoice Systems

Let’s delve into the specific updates announced for these systems:

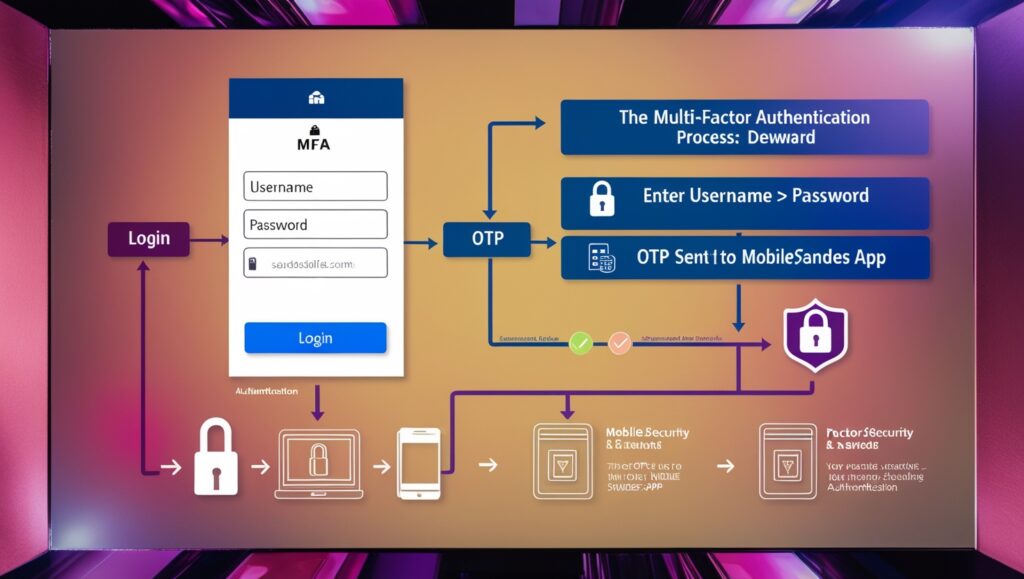

1. Implementation of Multi-Factor Authentication (MFA)

One of the most significant updates is the implementation of Multi-Factor Authentication (MFA) across the E-Way Bill and E-Invoice portals. MFA adds an additional layer of security by requiring users to verify their identity through multiple methods.

Current Status:

- Since August 20, 2023, MFA has been mandatory for taxpayers with an Annual Aggregate Turnover (AATO) exceeding ₹100 Crores.

- Since September 11, 2023, MFA has been optional for taxpayers with AATO exceeding ₹20 Crores.

New Requirements: Starting January 1, 2025, MFA will be rolled out in phases:

- From January 1, 2025: Mandatory for taxpayers with AATO exceeding ₹20 Crores.

- From February 1, 2025: Mandatory for taxpayers with AATO exceeding ₹5 Crores.

- From April 1, 2025: Mandatory for all other taxpayers and users.

How MFA Works: MFA requires users to log in using three elements:

- A username.

- A password.

- A one-time password (OTP) sent to the registered mobile number, Sandes app, or other authorized platforms.

Action Points for Taxpayers:

- Activate MFA immediately to familiarize yourself with the process.

- Ensure your registered mobile number is up to date on the GST portal to receive OTPs seamlessly.

- Follow the detailed instructions provided on the E-Way Bill and E-Invoice portals for activation.

2. Restriction on EWB Generation Based on Document Date

To ensure timely compliance, a new restriction is being introduced for E-Way Bill generation. Starting January 1, 2025, E-Way Bills can only be generated for documents dated within 180 days from the date of generation.

Example: If you attempt to generate an E-Way Bill on January 1, 2025, you can only use documents dated on or after July 5, 2024. Documents older than this date will not be eligible for EWB generation.

Impact on Taxpayers:

- Businesses must ensure that their invoices and related documents are issued promptly.

- Delays in document processing could lead to non-compliance, so it’s critical to monitor timelines closely.

3. Restriction on EWB Extension Period

The government is also limiting the extension period for E-Way Bills. From January 1, 2025, an E-Way Bill can only be extended within 360 days from its original date of generation.

Example: If an E-Way Bill is generated on January 1, 2025, it can only be extended up to December 25, 2025. Extensions beyond this period will not be allowed.

Implications:

- Businesses must plan their logistics carefully to avoid situations where an E-Way Bill expires without the possibility of extension.

- This rule ensures accountability and discourages misuse of E-Way Bill extensions.

Why These Updates Matter

The updates to E-Way Bill and E-Invoice Systems aim to address key challenges in India’s tax administration framework. Here’s why they are important:

- Enhanced Security:

- The introduction of MFA reduces the risk of unauthorized access and fraud. This is particularly crucial given the increasing digitization of tax processes.

- Improved Compliance:

- Time-bound restrictions on E-Way Bill generation and extensions encourage businesses to adhere to established timelines, reducing the scope for irregularities.

- Streamlined Processes:

- These updates simplify the management of invoices and logistics, making it easier for businesses to operate within the framework of GST laws.

- Alignment with Global Standards:

- By adopting practices like MFA, India’s GST systems are aligning with international benchmarks for security and efficiency.

What Taxpayers Should Do

To ensure smooth compliance with these updates, taxpayers and businesses should take the following steps:

- Activate Multi-Factor Authentication (MFA):

- Don’t wait for the mandatory deadlines. Activate MFA now to avoid disruptions later.

- Ensure your registered mobile number is accurate and functional.

- Review Invoice and Document Timelines:

- Keep track of the 180-day window for E-Way Bill generation and ensure invoices are issued on time.

- Plan Logistics Effectively:

- Ensure that your goods are transported and received within the allowable extension period for E-Way Bills.

- Educate Your Team:

- Train your staff on these updates to minimize errors and delays in compliance.

- Leverage Portal Resources:

- Visit the E-Way Bill and E-Invoice portals for detailed instructions, FAQs, and support.

Conclusion

The updates to E-Way Bill and E-Invoice Systems mark a significant step forward in India’s tax administration. By enhancing security through MFA and streamlining compliance timelines, these changes will benefit businesses and the government alike. However, the success of these updates depends on proactive adoption by taxpayers.

Businesses should act immediately to adapt their processes and ensure seamless compliance. With the right preparations, these updates can lead to more efficient and secure tax operations for everyone involved.

For more details and assistance, taxpayers are encouraged to visit the E-Way Bill and E-Invoice portals and stay informed about the latest developments.

For more update GST visit here.