Today we take about Deemed Export Refund Filing GST 2025, The Goods and Services Tax Network (GSTN) has introduced significant changes in the deemed export refund filing process under GST to simplify and optimize the experience for taxpayers. These updates, effective from May 2025, aim to enhance the accuracy, flexibility, and ease of filing for refund claims specifically under the category “On account of Refund by Recipient of deemed export”.

In this blog, we’ll explore the key updates in the deemed export refund filing GST 2025, how they impact taxpayers, and what changes to expect in the process.

No Chronological Order Required for Refund Filing

One of the most impactful changes in the deemed export refund filing GST 2025 is the removal of the requirement to file refund applications in chronological order based on tax periods.

What this means for taxpayers:

- You no longer need to select the “From Period” and “To Period” while filing refund applications.

- Refunds can now be filed for any eligible tax period, regardless of previous filings.

This update brings more flexibility and reduces delays caused by pending refunds from earlier tax periods.

Mandatory Filing of All GST Returns Before Refund Application

Before applying for a refund under this category, taxpayers must ensure that all the due returns like GSTR-1 and GSTR-3B have been filed up to the date of application.

Why this matters:

- Refund applications will only be accepted if you are fully compliant with your GST return filings.

- It ensures authenticity and avoids complications during refund processing.

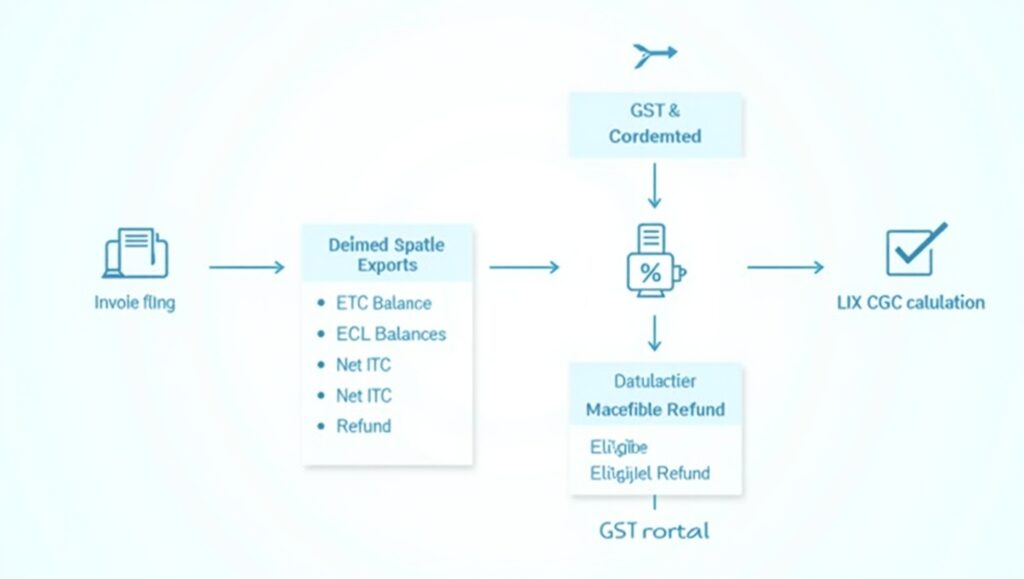

Modified “Amount Eligible for Refund” Table

The refund table under the deemed export refund filing GST 2025 has been restructured for better clarity. Below is a breakdown of the five revised columns:

| Column | Description |

|---|---|

| Col. 1 | Balance in Electronic Credit Ledger (ECL) – Auto-populated at the time of filing. |

| Col. 2 | Net Input Tax Credit (ITC) of Deemed Exports – Based on Statement 5B invoices. |

| Col. 3 | Refund Amount as per Uploaded Invoices – Downward editable by the taxpayer. |

| Col. 4 | Eligible Refund Amount – Auto-calculated as per Circular No. 125/44/2019-GST. |

| Col. 5 | Ineligible Refund Amount Due to Insufficient ECL Balance – Shows shortfall. |

These columns improve visibility into how refund amounts are derived and what limits apply.

Maximized Refund Claim Functionality

A major enhancement in deemed export refund filing GST 2025 is the ability to claim refunds even when specific Head-wise balances in the Electronic Credit Ledger are insufficient.

How it works:

- The total ITC across all major Heads (IGST, CGST, SGST/UTGST) will be considered.

- This ensures that taxpayers get the maximum refund benefit based on their uploaded invoices.

This feature reduces refund claim denials caused by minor mismatches between ITC balances under different Heads.

Grievance Redressal Portal for Issues

If any taxpayer faces issues while filing their refund under the deemed export category, they are encouraged to raise a grievance on the GST Self-Service Portal:

Grievance Link: https://selfservice.gstsystem.in/ReportIssue.aspx

This ensures timely resolution and smooth transition under the updated process.

Conclusion

The latest updates in deemed export refund filing GST 2025 reflect a more streamlined and taxpayer-friendly approach. From removing chronological restrictions to enhancing refund calculations and enabling head-wise optimization, these reforms aim to improve refund turnaround time and ease of compliance.

Taxpayers are advised to carefully review the new refund table, ensure all returns are filed, and utilize the enhanced portal features to make the most of these changes.

FAQs – Deemed Export Refund Filing GST 2025

What is the latest change in refund filing for deemed exports under GST in May 2025?

Do I need to file all GST returns before applying for a refund under deemed export?

What does the updated refund table include?

Can I get a refund if there is insufficient ITC in one head like IGST or CGST?

Where can I report a problem related to refund filing?

👉 Try the Income Tax Calculator Now and make informed decisions for FY 2024-25.