Key Changes in GST and Income Tax Effective from October 1, 2024

This article highlights the GST and TDS Updates, Income Tax, and TDS rates, as well as amendments to key sections effective from October 1, 2024, providing clarity for taxpayers and companies alike.

Several important GST and TDS Updates are set to take effect from October 1, 2024, impacting GST, Income Tax, and TDS rates. These changes are designed to streamline processes and ensure better compliance for taxpayers and companies. Here’s a summary of the key GST and TDS Updates:

GST Updates

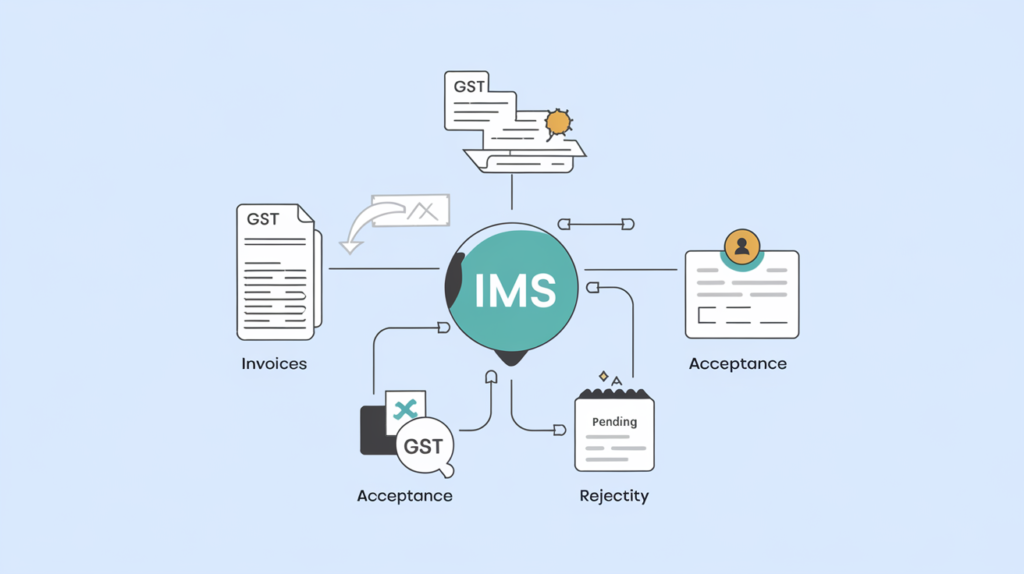

- Introduction of Invoice Management System (IMS):

A new Invoice Management System (IMS) will be introduced on the GST portal, allowing taxpayers to better manage invoice corrections. The system enables taxpayers to accept, reject, or keep invoices pending, improving the accuracy of Input Tax Credit (ITC) claims. - Improved Communication on GST Portal:

The IMS will facilitate seamless communication between taxpayers and suppliers, helping resolve invoice discrepancies and ensuring g better record matching for accurate ITC claims. - IMS Availability from October 1, 2024:

Taxpayers can begin using the IMS on the GST portal starting October 1, 2024, helping streamline invoice management processes.

Income Tax Updates

- Extension of Tax Audit Deadline:

The due date for Income Tax Audit under section 44AB has been extended from September 30, 2024, to October 7, 2024, giving taxpayers additional time to meet their audit requirements. - Changes to Tax on Buyback of Shares (Section 115BQA):

Under Section 11BQA, tax on the buyback of shares is no longer payable by companies. Instead, the tax will be payable by shareholders receiving the buyback proceeds. - Amendment to Section 192:

Starting October 1, 2024, Section 192 has been amended as follows:- Additional Income Declaration: Employees can provide their employers with details of income from other heads (excluding losses, except from house property) for the purpose of tax deduction.

- Tax Deduction: Employers are required to consider this additional income and any tax deducted or collected when deducting tax from salaries.

- Restrictions: This provision does not allow the tax deduction from salaries to be reduced except for house property losses and certain specified taxes.

- Amendment to Section 194-IA:

From October 1, 2024, a new proviso has been added to Section 194-IA:- When multiple buyers or sellers are involved in the transfer of immovable property, the consideration amount for TDS will be based on the total consideration paid by all buyers to all sellers.

- Each buyer is required to deduct 1% TDS if the joint purchase exceeds ₹50 lakh, applicable to their respective payment to the seller.

- Amendment to Section 197:

Section 197 has been amended to include Section 194Q, effective from October 1, 2024. This amendment allows for the issuance of a no tax deduction certificate for payments under Section 194Q.

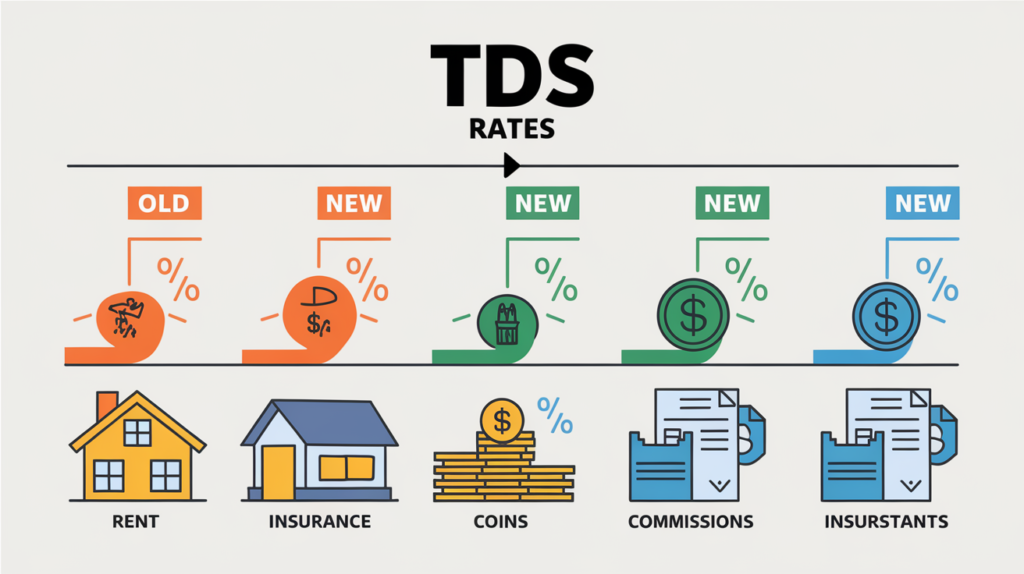

TDS Rate Changes for FY 2024 (Part 2)

The Finance Act 2024 has introduced several changes to TDS (Tax Deducted at Source) rates. Below are the key updates:

- Section 194DA (Payment of LIC):

- New Rate: 2%

- Old Rate: 5%

- Section 194F (Repurchase of units by MF & UTI):

- Omitted

- Section 194G (Commission on Lottery):

- New Rate: 2%

- Old Rate: 5%

- Section 194H (Payment of commission or brokerage):

- New Rate: 2%

- Old Rate: 5%

- Section 194IA (Payment for immovable property):

- Clarification: The term ‘consideration’ now refers to total consideration in cases of multiple buyers or sellers.

- Section 194IB (Payment of rent by individuals):

- New Rate: 2%

- Old Rate: 5%

- Section 194M (Certain sums by certain individuals):

- New Rate: 2%

- Old Rate: 5%

- Section 194O (Payment by E-commerce Operator to online sellers):

- New Rate: 0.1%

- Old Rate: 1%

Other Updates

- Increase in Securities Transaction Tax (STT):

Starting October 1, 2024, there will be an increase in the Securities Transaction Tax (STT) for Futures and Options (F&O):- Futures Contracts: STT on the sale of futures contracts will rise from 0.0125% to 0.02% of the traded price.

- Options Contracts: STT on the sale of options contracts will increase from 0.0625% to 0.1% of the option premium.

For detailed insights on “Understanding the Invoice Management System (IMS) Under GST: A Complete Guide” please refer to this resource. for further GST and TDS Updates stay turn with us.