Introduction to the GST Invoice Management System (IMS)

With the introduction of the Invoice Management System (IMS) on the GST portal, taxpayers can now handle invoice corrections or amendments more efficiently. This system is set to enhance the overall Input Tax Credit (ITC) mechanism by allowing recipient taxpayers to accept, reject, or keep invoices pending until further action. IMS aims to facilitate a smoother experience for taxpayers by ensuring that only accepted invoices become part of GSTR-2B, thus minimizing errors and boosting accuracy in filing returns.

This facility shall be available to the taxpayer from 1st October 2024 onwards on the GST portal

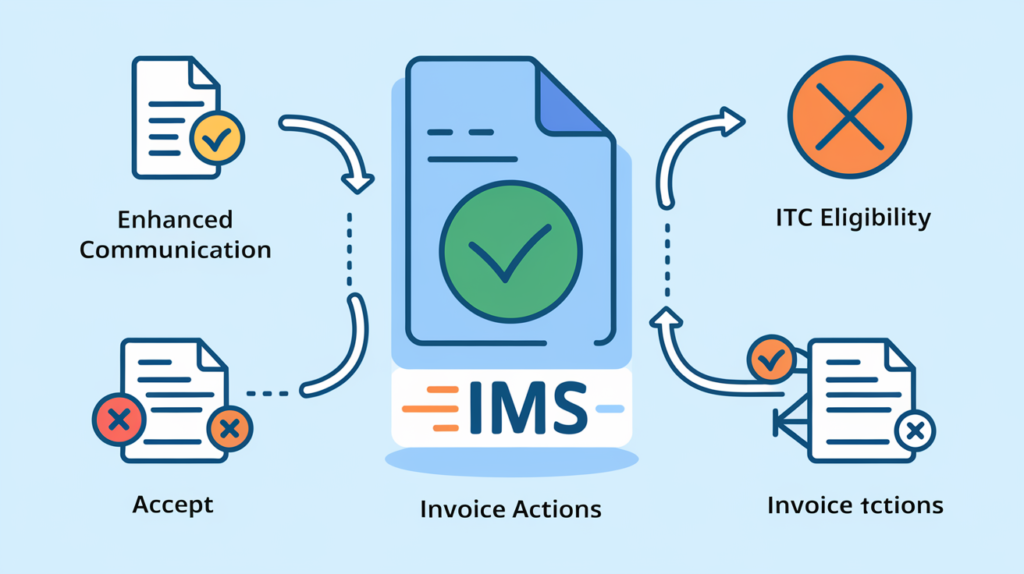

Key Features of the Invoice Management System

1. Enhanced Communication Between Taxpayers and Suppliers:

- Invoice Management System allows recipient taxpayers to directly manage invoices from their suppliers via the GST portal.

- Once a supplier uploads an invoice in GSTR-1/IFF/1A, it becomes visible to the recipient on their IMS dashboard.

2. Improved ITC Ecosystem:

- Only accepted invoices will be eligible for Input Tax Credit, and these invoices will be reflected in the GSTR-2B.

- IMS ensures that taxpayers can validate the genuineness of the invoices received, helping to reduce errors and disputes.

3. Options for Recipients:

- Recipients can take one of three actions on an invoice:

- Accept: The invoice will be added to the “ITC Available” section of GSTR-2B.

- Reject: The invoice will be marked as ineligible for ITC and will not be considered in GSTR-2B.

- Pending: The invoice will be retained for future action but will not be considered for ITC until accepted.

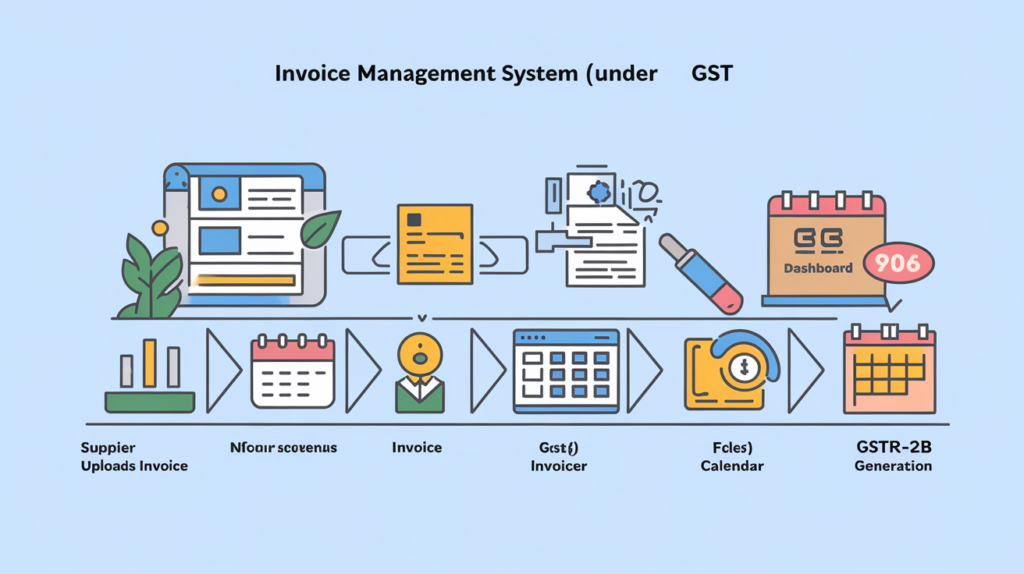

IMS Workflow and Process

The workflow of the Invoice Management System integrates seamlessly with existing GST return filing mechanisms:

- Dashboard View: All invoices issued by suppliers will populate the IMS dashboard of the recipient. Recipients can track actions taken on each invoice.

- GSTR-2B Generation: A draft GSTR-2B will be generated on the 14th of every month based on the recipient’s actions. If no action is taken, the invoice will be “deemed accepted.”

- Revisions and Amendments: If a supplier amends an invoice before filing GSTR-1, the updated invoice will replace the original one in the IMS dashboard. In case of GSTR-1A amendments, changes will be reflected in the subsequent month’s GSTR-2B.

Key Points on the Invoice Management System (IMS)

To help taxpayers better understand the functioning of IMS, here are the key points to note:

- Deemed Accepted: If no action is taken on an invoice by the recipient, it will be considered as ‘deemed accepted’ at the time of GSTR-2B generation.

- Mandatory Recalculation of GSTR-2B: If any action is taken on an invoice after the draft GSTR-2B is generated (on the 14th of each month), the recipient must recompute the GSTR-2B from the IMS dashboard.

- Direct Population to GSTR-3B: Certain records will bypass the IMS and be directly populated into GSTR-3B, such as:

- Inward RCM supplies reported by the supplier in Table 4B of IFF or GSTR-1/GSTR-1A.

- Supplies where ITC is not eligible as per Section 16(4) of the CGST Act or based on Place of Supply (POS) rules.

- Flow of Records: Once the supplier saves the invoice, it appears in the recipient’s IMS dashboard for action. However, the invoice will be included in GSTR-2B only after the supplier files the return (GSTR-1/IFF/GSTR-1A).

- Moving Out of the IMS Dashboard: Accepted, deemed accepted, or rejected invoices will move out of the IMS dashboard once GSTR-3B is filed for the respective period.

- Pending Records: Invoices that are kept pending by the recipient will remain in the IMS dashboard for future action. They can be accepted or rejected in subsequent months.

- Amendments on Records: Action must be taken on the original invoice, and GSTR-3B for that period must be filed before processing amended invoices when the original and amended records belong to different GSTR-2B periods. If both records belong to the same period, only the amended invoice will be considered for ITC calculation.

- Resetting Record Status: Any changes made to an invoice before the supplier files GSTR-1/1A/IFF will reset the record’s status on the recipient’s IMS dashboard.

- Sequential GSTR-2B Generation: The system will only generate GSTR-2B for a period if GSTR-3B for the previous period has been filed, ensuring that the ITC flow remains sequential.

- Supplier Liability for Rejected Invoices: If an invoice is rejected in IMS by the recipient, the supplier’s liability will be increased in the subsequent tax period for specific transactions, including:

- Original credit notes rejected by the recipient.

- Upward or downward amendments of invoices or credit notes rejected by the recipient irrespective of the action taken by the recipient on the original credit note.

- Downward amendment of the credit note rejected by the recipient if original credit note was rejected by him

- Downward amendment of Invoice/ Debit note rejected by the recipient where original

- Invoice/ Debit note was accepted by him and respective GSTR 3B has also been filed.

Special Considerations for QRMP Taxpayers

- Monthly vs. Quarterly Generation: For Quarterly Return Monthly Payment (QRMP) taxpayers, GSTR-2B is generated quarterly. However, records filed via IFF for M-1 and M-2 months will appear in IMS but won’t be reflected in GSTR-2B until the final quarter.

- Sequential Generation of GSTR-2B: IMS ensures that GSTR-2B for a new period is generated only after the previous month’s GSTR-3B has been filed, maintaining an orderly process.

Conclusion

The introduction of Invoice Management System marks a significant milestone in streamlining GST processes, making it easier for taxpayers to manage their invoices and avail the correct ITC. With the system set to go live from October 1st, it’s crucial for taxpayers to familiarize themselves with the new functionality to ensure smooth compliance with GST norms.

This move aims to enhance transparency, improve communication between taxpayers and suppliers, and ultimately reduce compliance burdens while ensuring that ITC is claimed on genuine invoices.

Calculate Income Tax 10 LPA India :- click here

For detailed insights on “RCM Liability: New Feature Alert on GST Portal” please refer to this resource.