The Revolutionary PAN 2.0 Project: Transforming Taxpayer Services

On November 25, 2024, the Cabinet Committee on Economic Affairs (CCEA) approved the PAN 2.0 Project, marking a significant step forward in transforming taxpayer services in India. Spearheaded by the Income Tax Department, this project is set to modernize and unify the issuance and management of Permanent Account Numbers (PAN) and Tax Deduction and Collection Account Numbers (TAN) under one seamless platform.

For years, taxpayers and businesses have had to navigate multiple portals—such as the e-Filing portal, UTIITSL portal, and Protean e-Gov portal—to access PAN and TAN services. This fragmented system often resulted in delays, confusion, and inefficiencies. By integrating all these services into a single platform, PAN 2.0 aims to address these challenges, offering a user-friendly and streamlined experience. This initiative holds immense significance, especially given India’s over 78 crore PAN holders and 73.28 lakh TAN holders.

Key Objectives of PAN 2.0

The PAN 2.0 Project is built on the principles of simplicity, efficiency, and user convenience. Its main objectives include:

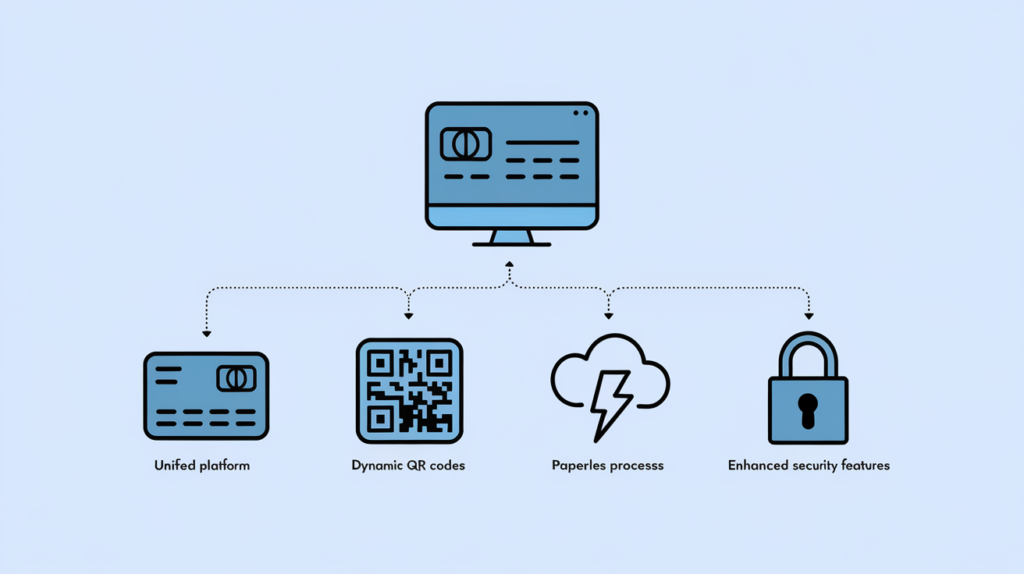

- Integrated Platform

All PAN and TAN-related services—applications, updates, corrections, Aadhaar-PAN linking, and reissuance—will be accessible through one unified system. This eliminates the need to juggle multiple platforms, saving time and effort for users. - Paperless, Eco-Friendly Processes

As part of the Digital India Initiative, PAN 2.0 emphasizes a paperless workflow. This not only reduces paperwork but also aligns with India’s goals for environmental sustainability. - Universal Identifier

PAN will act as a universal business identifier across digital systems of various government agencies. This simplifies compliance and enhances consistency for businesses and individuals alike. - Enhanced Data Security

The introduction of advanced features like the PAN Data Vault ensures that taxpayer data is safeguarded against misuse, offering a secure and trustworthy system.

Cost-Free Services

The issuance of PAN, e-PAN, and corrections will now be free of cost, with only a minimal charge for physical PAN cards.

Highlights of the PAN 2.0 Project

The PAN 2.0 initiative brings a host of innovative features to improve the efficiency and reliability of PAN and TAN services.

- Dynamic QR Codes

PAN cards will feature dynamic QR codes, enabling users to instantly verify the latest details, such as name, address, and date of birth, from the PAN database. - Faster Service Delivery

With re-engineered processes, taxpayers can expect quicker application processing and resolution of grievances. This eliminates long waiting times and enhances overall efficiency. - Dedicated Helpdesk

A 24/7 helpdesk will assist users with queries and issues, ensuring a smoother service experience. - Real-Time Updates

Taxpayers can now update their details, such as address, email, and mobile number, online for free. These changes will reflect in real-time, ensuring accuracy and convenience. - Eliminating Duplicate PANs

The system incorporates advanced logic to identify and eliminate duplicate PANs, ensuring compliance and reducing redundancy.

How PAN 2.0 Benefits Taxpayers

The PAN 2.0 Project is set to revolutionize the taxpayer experience by offering a host of benefits:

- Simplified Access

By consolidating all PAN and TAN services under one roof, taxpayers can perform tasks like Aadhaar-PAN linking, corrections, and validations effortlessly. - Cost Efficiency

The free issuance of e-PANs and updates eliminates additional financial burdens for taxpayers. - Enhanced Security

The PAN Data Vault and other security features protect sensitive taxpayer information, fostering trust in the system. - Improved Grievance Redressal

With a centralized platform and a dedicated helpdesk, taxpayers can expect quicker resolutions to their concerns. - Eco-Friendly Processes

The move to paperless operations not only simplifies workflows but also supports environmental sustainability.

Why PAN 2.0 is a Milestone for Digital India

The PAN 2.0 Project underscores India’s commitment to harnessing technology for efficient governance. By simplifying processes, eliminating redundancies, and prioritizing user convenience, it aligns perfectly with the objectives of the Digital India Initiative.

For taxpayers, the integration of PAN and TAN services under a single platform ensures transparency and ease of use. Businesses stand to benefit from streamlined operations, reduced compliance burdens, and enhanced security measures.

With the introduction of features like dynamic QR codes, real-time updates, and a dedicated helpdesk, PAN 2.0 is more than just a technological upgrade—it’s a vision of a future where governance is efficient, transparent, and citizen-centric. As PAN evolves into a universal identifier, it promises to redefine the way taxpayers and businesses interact with India’s financial systems. The PAN 2.0 Project is not just about technology; it’s about creating a better experience for millions of Indians while advancing the nation’s digital transformation goals

1. Do existing PAN holders need to reapply for PAN under PAN 2.0?

2. What is the purpose of QR codes on PAN cards?

3. How does PAN 2.0 address duplicate PANs?

4. Will physical PAN cards still be issued?

5. How will PAN 2.0 benefit businesses?

For more update GST Visit here.