Waiver Scheme Under Section 128A: Key Details About SPL-01 and SPL-02

The Waiver Scheme under Section 128A was introduced by the GST Council to ease tax disputes and offer relief to taxpayers. This scheme focuses on waiving interest and penalties for eligible cases, provided certain conditions are met. Central to the scheme are SPL-01 and SPL-02, the forms required for taxpayers to avail of these benefits. Let’s explore the details of the scheme and the process involving these forms.

What is the Waiver Scheme Under Section 128A?

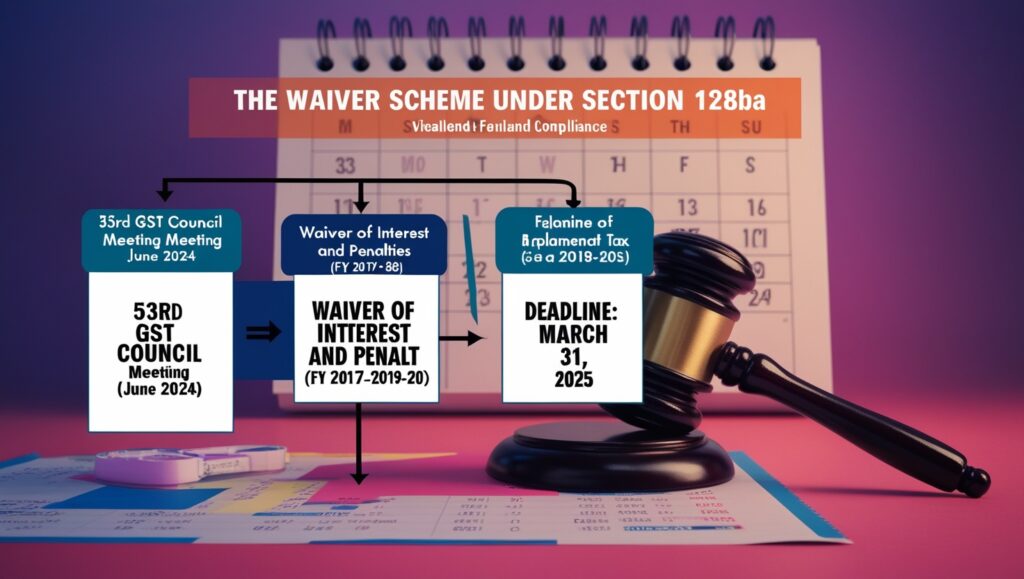

The GST Council, in its 53rd meeting held on June 22, 2024, recommended waiving interest and penalties for tax demand notices or orders issued under Section 73 of the CGST Act, 2017. These cases exclude fraud, suppression of facts, or willful misstatements.

Key Highlights:

- Applicable for the financial years 2017–18, 2018–19, and 2019–20.

- Condition: Taxpayers must pay the full tax amount demanded on or before March 31, 2025.

To implement the scheme, Rule 164 of the CGST Rules, 2017, was notified through Notification No. 20/2024 on October 8, 2024, effective from November 1, 2024. This rule provides procedural guidelines for availing the waiver.

The Application Process for SPL

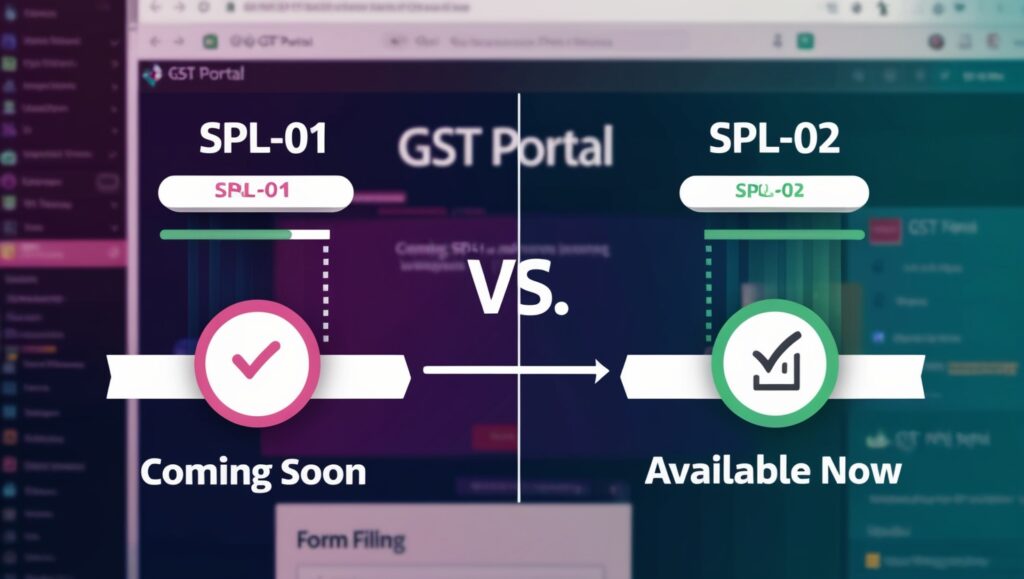

To apply for the waiver scheme, taxpayers are required to file an application using either SPL-01 or SPL-02 on the GST portal, depending on their case. These forms are critical for the formal application process.

Key Updates on SPL-01 and SPL-02:

- SPL-02:

- Form SPL-02 is now available on the GST portal.

- Taxpayers can file this form electronically following the detailed process outlined in the help document.

- SPL-01:

- Form SPL-01 is under development and will be made available soon.

Taxpayers are advised to monitor the portal for updates

Payment Guidelines

Taxpayers must ensure that the full tax amount mentioned in the notice, statement, or order under Section 73 is paid before March 31, 2025, to avail of the waiver benefits.

How to Make Payments:

- Demand Orders: Use the “payment towards demand” facility on the GST portal.

- Notices: Make payments through Form GST DRC-03.

- If payment has already been made through Form GST DRC-03, link it to the demand order using Form GST DRC-03A, now available on the GST portal.

Support for Filing SPL-02

Taxpayers encountering difficulties in filing SPL-02 or other issues related to the waiver scheme can raise a ticket on the GST self-service portal under the category “Issues related to Waiver Scheme.”

Additionally, taxpayers can refer to the advisory released on November 8, 2024, for further details. The advisory is accessible through this link.

Conclusion

The Waiver Scheme under Section 128A offers an excellent opportunity for taxpayers to resolve disputes from 2017 to 2020 by paying only the demanded tax amount without worrying about interest and penalties.

Taxpayers are urged to take advantage of this scheme by filing the required forms—SPL-01 and SPL-02—and ensuring compliance before the March 31, 2025, deadline. Stay updated on further developments through the GST portal and advisories.

What is the Waiver Scheme under Section 128A?

Who is eligible for the waiver scheme

What is the deadline to avail of the waiver scheme?

How can taxpayers pay the demanded tax under the scheme?

What happens if I’ve already paid the demanded tax using Form GST DRC-03?

What are SPL-01 and SPL-02?

Where can I find Form SPL-01 and SPL-02?

What should I do if I face issues with SPL-01 or SPL-02?

For more update GST or Tax visit here.